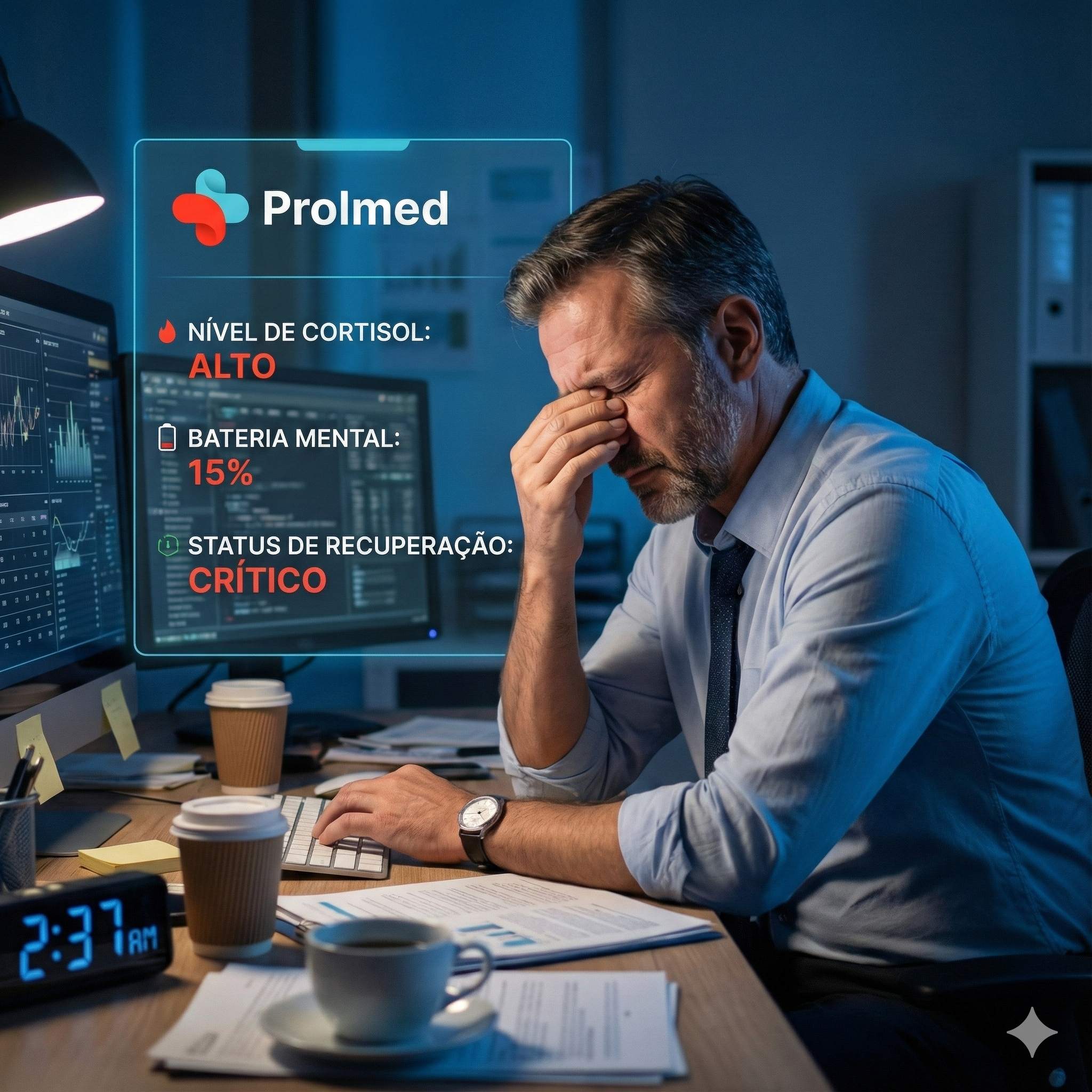

Recentemente, a exaustão mental, a falta de direcionamento, o cochilo fraco e o burnout têm passado a ser cada vez mais prevalentes, Particularmente entre os especialistas que enfrentam significativas necessidades e pressão constante. Em regiões como Manaus, Amazonas, onde o acesso ao cuidados especializados de saúde geral mental poderia ser limitado, opções digitais inovadoras são cruciais. A Prolmed surge como uma plataforma número um de telemedicina focada em bem-estar mental, clareza e eficiência sustentável, apresentando cuidado fundamentado em ciência, humanizado e totalmente na web. A Prolmed não é meramente outro assistência de telemedicina. Sua missão central é cuidar de as bases raiz da cansaço psicológica, da estresse, do TDAH, do burnout e dos problemas do dormir, em lugar de simplesmente mascarar indicadores. Por meio de uma estratégia profissional estruturada e personalizada, a sistema conecta clientes a médicos licenciados que atuam em saúde e qualidade de vida psicológica e efetividade cognitivo, assegurando cuidado confiável, privado e poderoso. Certamente um dos importantes diferenciais da Prolmed é seu protocolo guiado. Cada um paciente inicia sua jornada acompanhando indicações por meio de um formulário online desenvolvido para avaliar a exaustão mental, problemas de concentração, o harmonia emocional e a excelência do sono. Essa avaliação inicial ajuda que os médicos se organizem para uma consulta ainda mais exata e significativa, viabilizando que conheçam a agenda de cada cliente, seus problemas e seu registro de saúde antes da primeira consulta. A análise de saúde é conduzida via teleconsulta com profissionais médicos que possuem registros CRM válidos e atuam em total conformidade com as regulamentações do CFM. Essas consultas não costumam ser apressadas ou superficiais. A Prolmed valoriza a escuta compassiva, garantindo que os clientes se se sintam ouvidos, compreendidos e apoiados durante o seu cuidado. Esse modelo de cuidado humanizado resultou em índices de contentamento dos indivíduos acima de noventa e quatro%, refletindo credibilidade e desfechos estáveis. Após sessão, os pacientes obtêm um plano de procedimento inteiramente customizado. De acordo com exigências específicas, esse plano pode conter métodos de otimização do descanso, mudanças no forma de viver, avaliações médicos e medicamentos quando necessário. O propósito é restaurar a clareza psicológica, aumentar o equilíbrio psicológico e aumentar a produtividade sem empurrar os pessoas em direção à exaustão ou à dependência de soluções de rápido prazo. Mais um característica marcante da Prolmed é o seguimento contínuo. Diferente de uma apenas uma sessão, clientes aproveitam monitoramento contínuo, acompanhamentos agendados e assistência por chat assíncrono para clarificar incertezas entre consultas. Essa comunicação permanente assegura que os planos de tratamento sejam modificados em tempo real, maximizando a efetividade e os resultados de estendido prazo. A Sistema atende uma grande variedade de profissionais, tais como executivos, empreendedores, profissionais da área da saúde, e universitários que lutam contra exaustão persistente, insuficiência de concentração, baixa produtividade, ou sobrecarga emocional. Muitos clientes relatam progressos significativas em semanas. Segundo dados da Prolmed, 89% apresentam melhora da clareza psicológica dentro de 30 dias, noventa e dois% relatam maior nível de sono, 87% tornam-se mais produtivos, e noventa e um% se sentem emocionalmente muito mais equilibrados. Com mais de dois,500 pacientes atendidos por todo o Brasil e mais de 5 anos de experiência em telemedicina de saúde mental, a Prolmed desenvolveu uma forte reputação em cuidados fundamentados em provas científicas. Testemunhos destacam mudanças da rotina real, como a recuperação da disposição em somente três semanas, a duplicação da eficiência em um mês, e a eliminação do burnout em seis semanas por meio de suporte profissional constante. A Prolmed também prioriza a privacidade e a proteção. Todas as consultas e dados são 100% confidenciais, assegurando que os pacientes se sintam seguros em todo o seu acompanhamento. A Sistema foi projetada para respeitar o tempo dos usuários, oferecendo agendamentos adaptáveis e eliminando o estresse do deslocamento ou das filas de espera. Dentro de um ambiente onde a sobrecarga psicológica vem se tornando a norma, a Prolmed apresenta uma opção evidente: telemedicina guiada pela ciência, humanizada, focada em performance sustentável e bem-estar. Para aqueles cansados de acordar cansados, tendo dificuldades para focar, ou sentindo-se bloqueados no burnout, a Prolmed oferece um trajeto estruturado rumo à clareza psicológica, estabilidade, além de uma forma mais saudável de trabalhar—sem recorrer a autodestruição. ajuda para falta de foco